The Digital Pit

Sit Back and Enjoy the Kool-Aid

Disclaimer

To preface these are my own thoughts on the current market state, from countless hours of reading and research. With that being said I didn’t tell you what I was reading and therefore, could have been reading the wrong source. Take this as an opinion and not an action from a guy that likes to watch internet coins every day. (Do your own due diligence).

Strategy

Another week in the books and we got our “why”. For those that didn’t pull up an article this week, BlackRock filed for a spot ETF here. This immediately changed the tape and the narrative for the week, as buyers in size showed interest in the DEC 40k calls, and large spot buyers were seen in Coinbase Tuesday morning sweeping books.

While it is just an application and I still remain cautious, it comes at a very needed time to show institutional confidence in an industry that has been beaten up by regulators for a better part of the year. This quickly sent Bitcoin to over $30,000 and my comment stands. “In a year where crypto is dead, Bitcoin is +82% ytd”, showcasing the power of narratives and how price has such a large impact on retail participation.

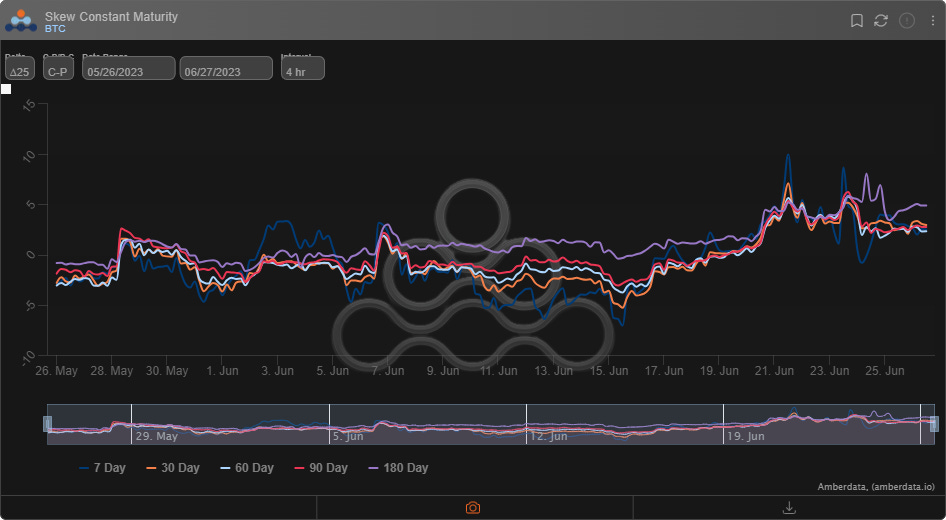

With the market flying and call buyers laying some wood with time, vol found a bid as we talked about previously. In order to have a sustained higher vol regime it is my belief we need markets up vol up. Let’s face it, at the end of the day outside of the “in it for the tech crowd” most of us are here for one reason volatility. With that being said let’s talk about vol this week. Skew in the back half of last week presented an incredible opportunity for traders and dealers to sell call risk to finance downside protection in the form of risk reversals. June 30th has $4.6B in notional expiring on Deribit, I would expect smart money took advantage of that opportunity last week, and for that reason, the downside likely remains contained as those puts become monetizable.

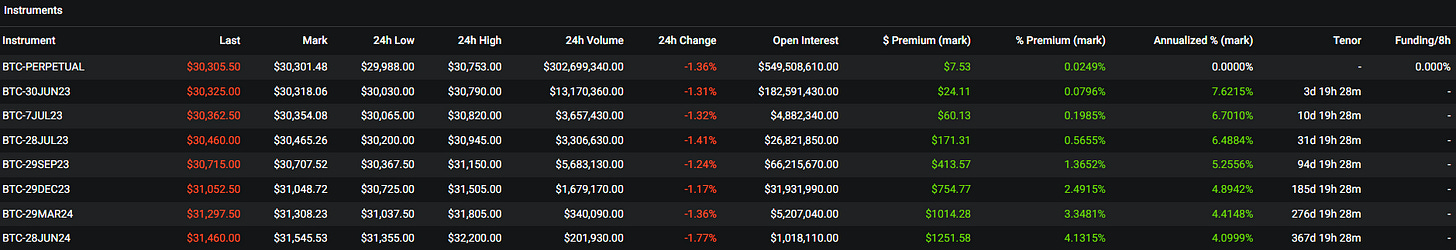

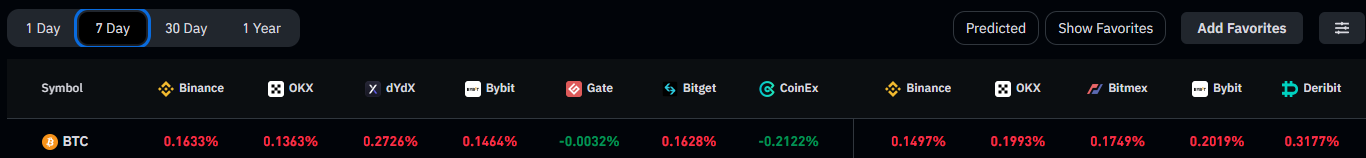

Skew to me this week is where the hints are going to lie on what is really going on under the hood. The next is the tape, and the most interesting trade I see with price stuck around $30k is in perp rates and in the CME basis. SEP CME Bitcoin is currently trading around $31k on the bid. This is 2.33% over the market with an annualized rate of 8.96%. This is an incredibly interesting trade to lock up some baseline yield. On top of that Deribit funding has continued to trade over to the tune of +.3177% in the last 7 days. This likely holds until spot finds its way lower, but for the time being this directly impacts markets and derivative positioning broadly. When you combo this yield with some long gamma structures, things get interesting…. I’ll leave you there.

BTC Options Juice

Skew remains elevated showing demand for calls at the very least over puts. Keep an eye here for hints on positioning under the hood.

BTC Futures

BTC curve lifted throughout last week’s move up in spot markets. Bitcoin Reference Rate continues to trade at a premium to exchanges with more leverage. SEP CME shows real promise with a decent yield this week.

BTC perp-funding market continues to trade over, impacting dealers’ cost to delta hedge. Keep an eye here.

Enjoy the week!